Pay TDS Online Easily: Everything You Need to Know

Paying TDS (Tax Deducted at Source) online has become a hassle-free process, saving taxpayers time and effort. Whether you are an employer deducting TDS from salaries or a business making vendor payments, online payment ensures compliance with tax laws and avoids penalties. This guide will walk you through the process, benefits, and key considerations when you pay TDS online.

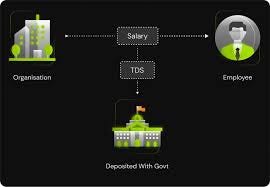

What is TDS and Why is it Important?

TDS is a tax collection mechanism where a certain percentage of tax is deducted at the source before making payments such as salaries, rent, professional fees, or interest. The deducted tax is then deposited with the government. Paying TDS online ensures timely compliance and reduces the burden of lump-sum tax payments.

Benefits of Paying TDS Online

- Convenience — No need to visit banks; payments can be made from anywhere.

- Instant Confirmation — Receive an immediate acknowledgment after successful payment.

- Error-Free Transactions — Online platforms minimize mistakes and allow corrections before submission.

- Time-Saving — Avoid long queues and process payments within minutes.

How to Pay TDS Online: Step-by-Step Process

- Visit the Official Portal — Go to the TIN-NSDL website.

- Select the Challan Form — Choose Challan No./ITNS 281 for TDS payments.

- Enter Details — Fill in PAN/TAN, assessment year, and payment type.

- Choose Payment Mode — Select net banking or debit card as the preferred option.

- Verify & Submit — Cross-check the details and proceed with payment.

- Download Receipt — Save the Challan 281 receipt as proof of payment.

Common Mistakes to Avoid When Paying TDS Online

- Incorrect TAN/PAN details — Always double-check before submitting.

- Wrong assessment year selection — Ensure you choose the correct financial year.

- Delayed payments — Late TDS deposits attract interest and penalties.

Conclusion

Making TDS payments online is a simple and efficient process that ensures timely tax compliance. Whether you are a business owner or an individual, following the correct procedure helps you avoid penalties and stay tax-compliant. Start using the pay TDS online option today for a seamless tax-paying experience.

Comments

Post a Comment